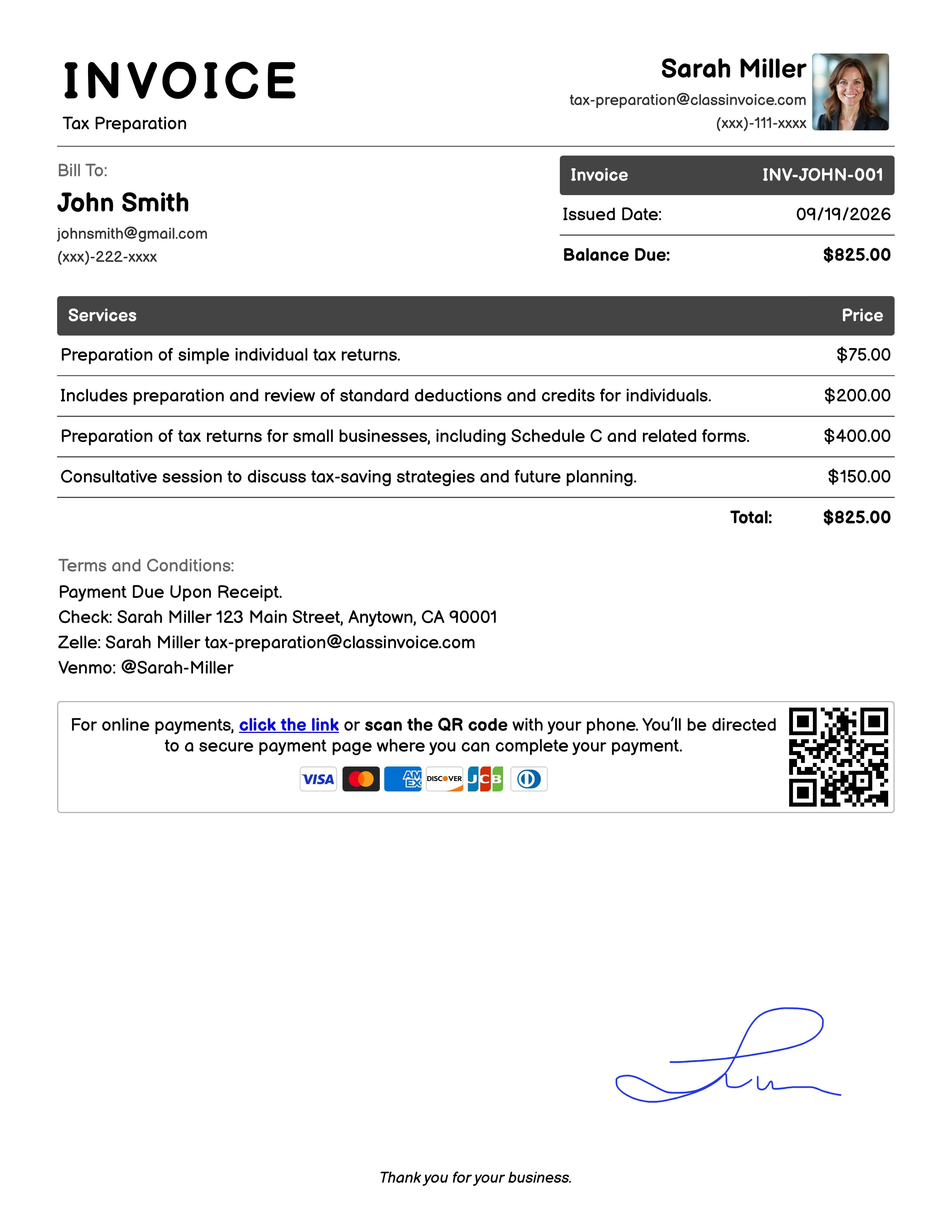

Free Tax Preparation Invoice Generator

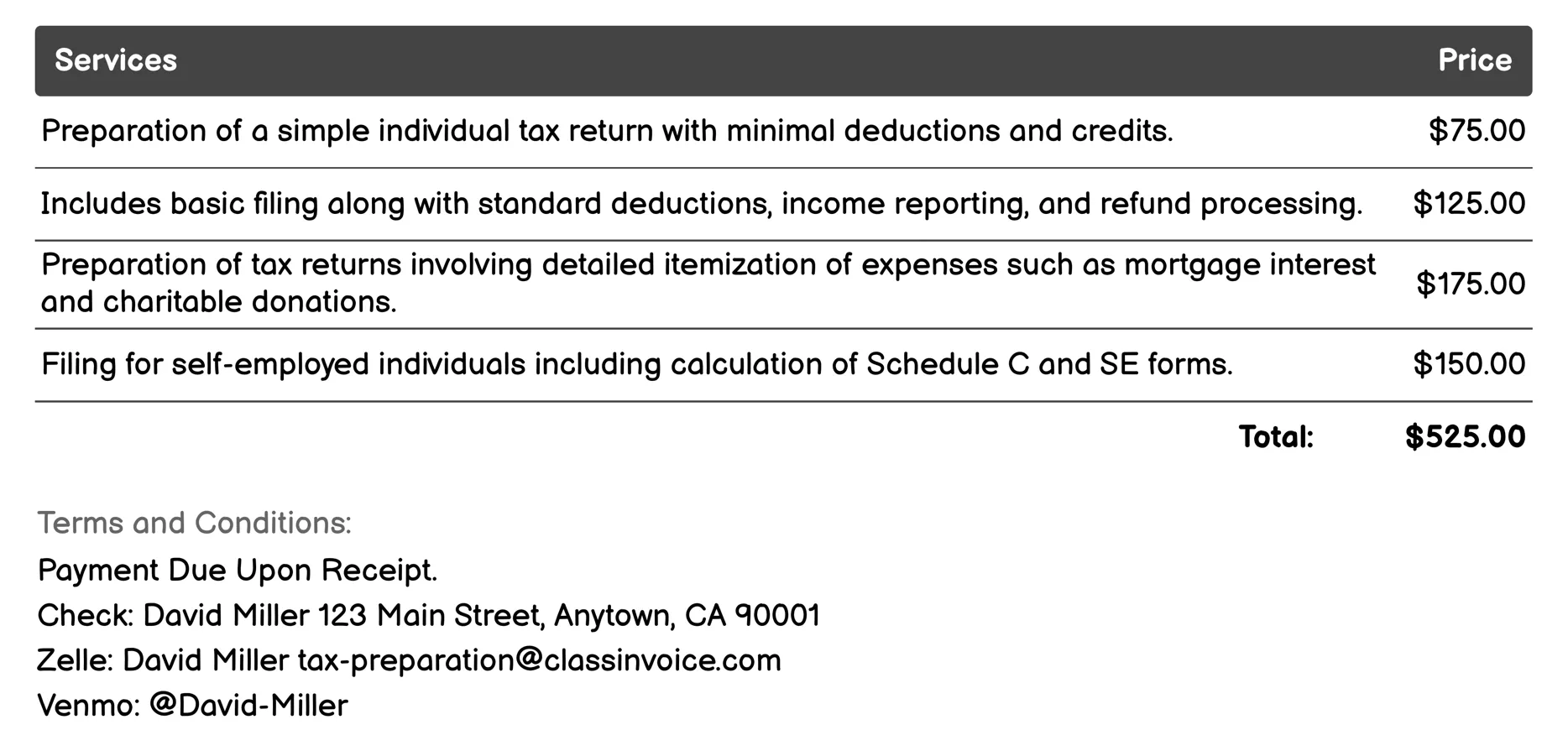

Individual Tax Return Filing Invoice

This service provides comprehensive tax preparation for individuals, covering various filing needs. It includes basic and standard filings, itemized deductions, self-employment specifics, investment income considerations, estimated payments, audit support, foreign income disclosures, amended returns, and retirement planning. Each option ensures accurate reporting and compliance with IRS requirements, catering to different financial situations and complexities.

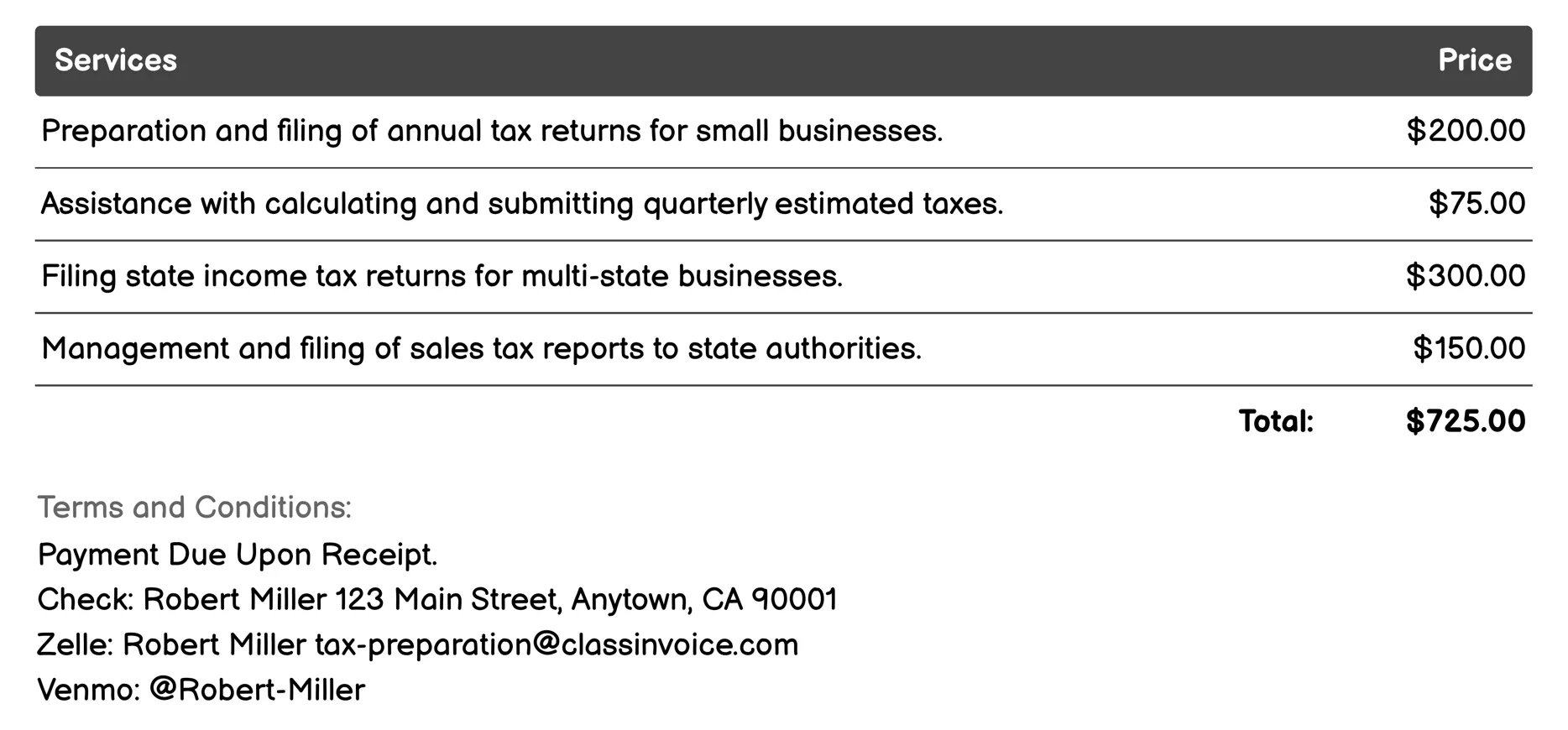

Small Business Tax Preparation Invoice

This service provides comprehensive tax preparation and compliance support for small businesses. It covers everything from filing annual tax returns to managing quarterly estimated taxes, ensuring state tax filings are accurate, and handling sales and payroll taxes efficiently. Businesses also benefit from optimized tax deductions and strategic planning to minimize future liabilities. Additionally, it offers audit support and ensures all necessary employee tax forms are prepared and distributed correctly. For businesses with international transactions, it provides guidance on foreign business compliance.

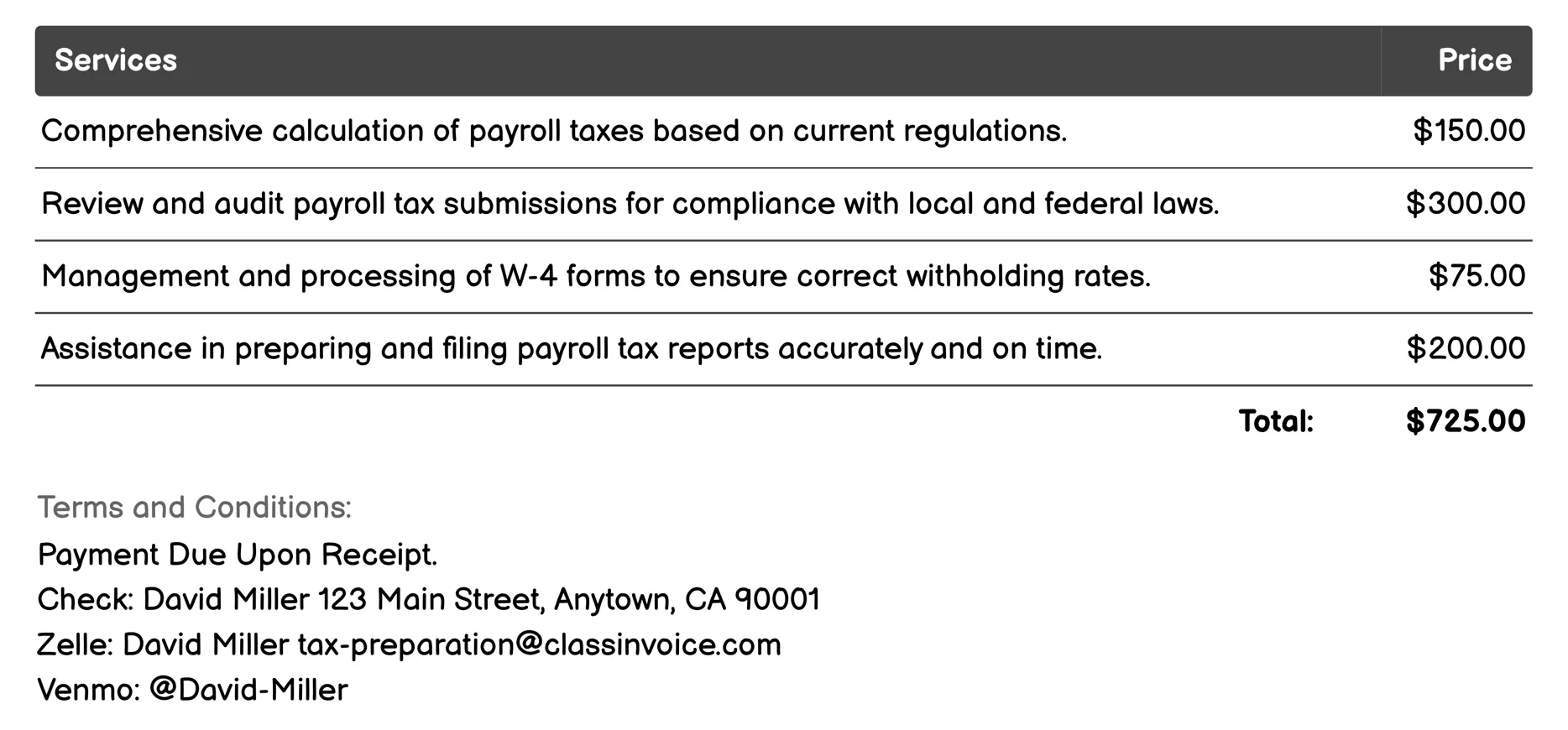

Payroll Tax Services Invoice

This service provides comprehensive support for managing payroll taxes, ensuring compliance and optimization. It includes calculating federal, state, and local payroll taxes; auditing tax submissions to meet legal requirements; processing employee withholding forms like W-4s; assisting with accurate payroll tax reporting and filing; and offering expert consultations on specific payroll tax issues. This ensures timely payments, minimizes liabilities, and optimizes deductions for business benefits.

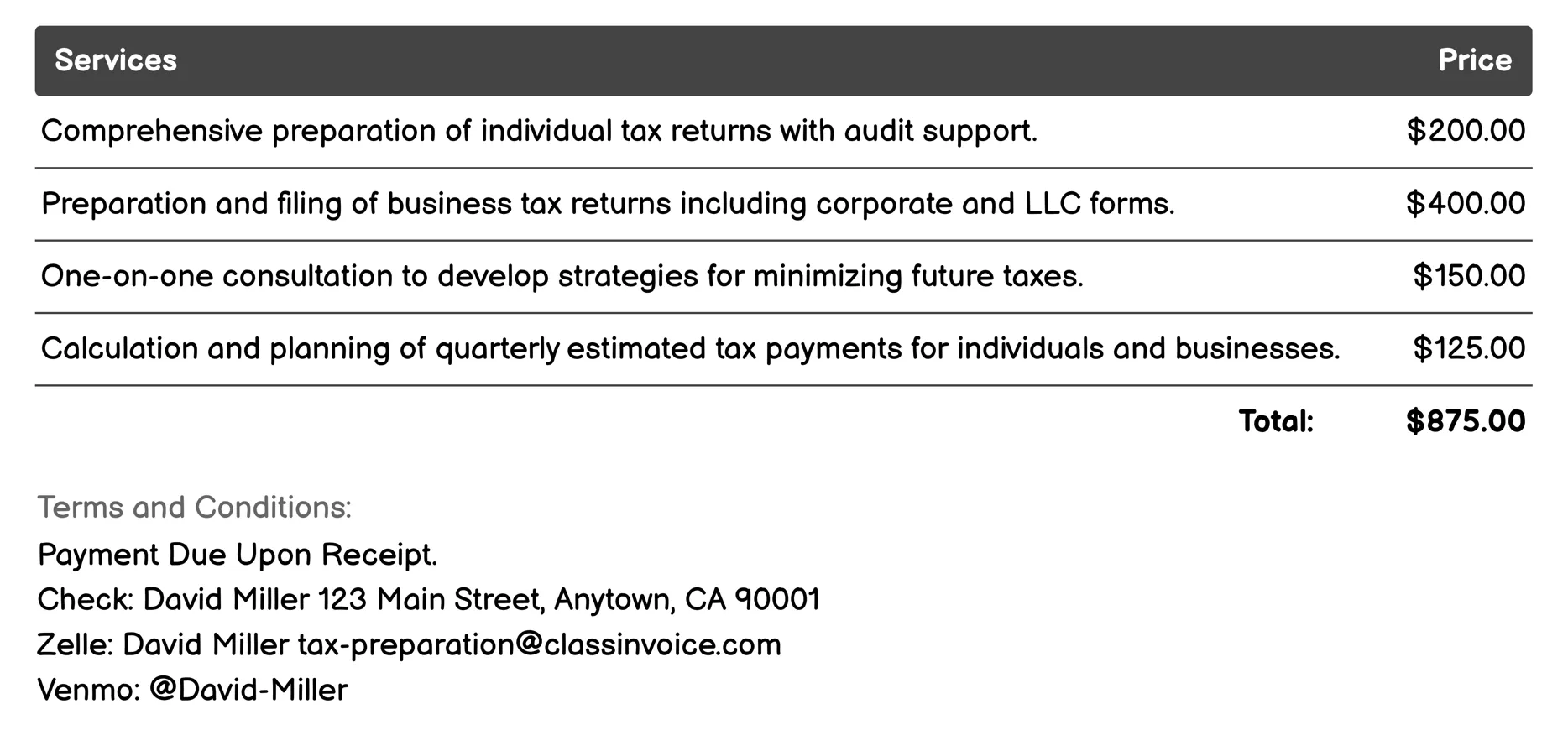

Tax Planning Consultation Invoice

This service offers comprehensive tax solutions including preparation and consultation for both individuals and businesses. It covers individual and corporate tax returns, strategic planning to minimize future taxes, calculation of estimated taxes, and identification of potential deductions. Additional services include filing tax extensions, amending past returns, reporting foreign assets, and analyzing available tax credits. The goal is to ensure accurate filings, optimize tax strategies, and provide audit support for peace of mind.

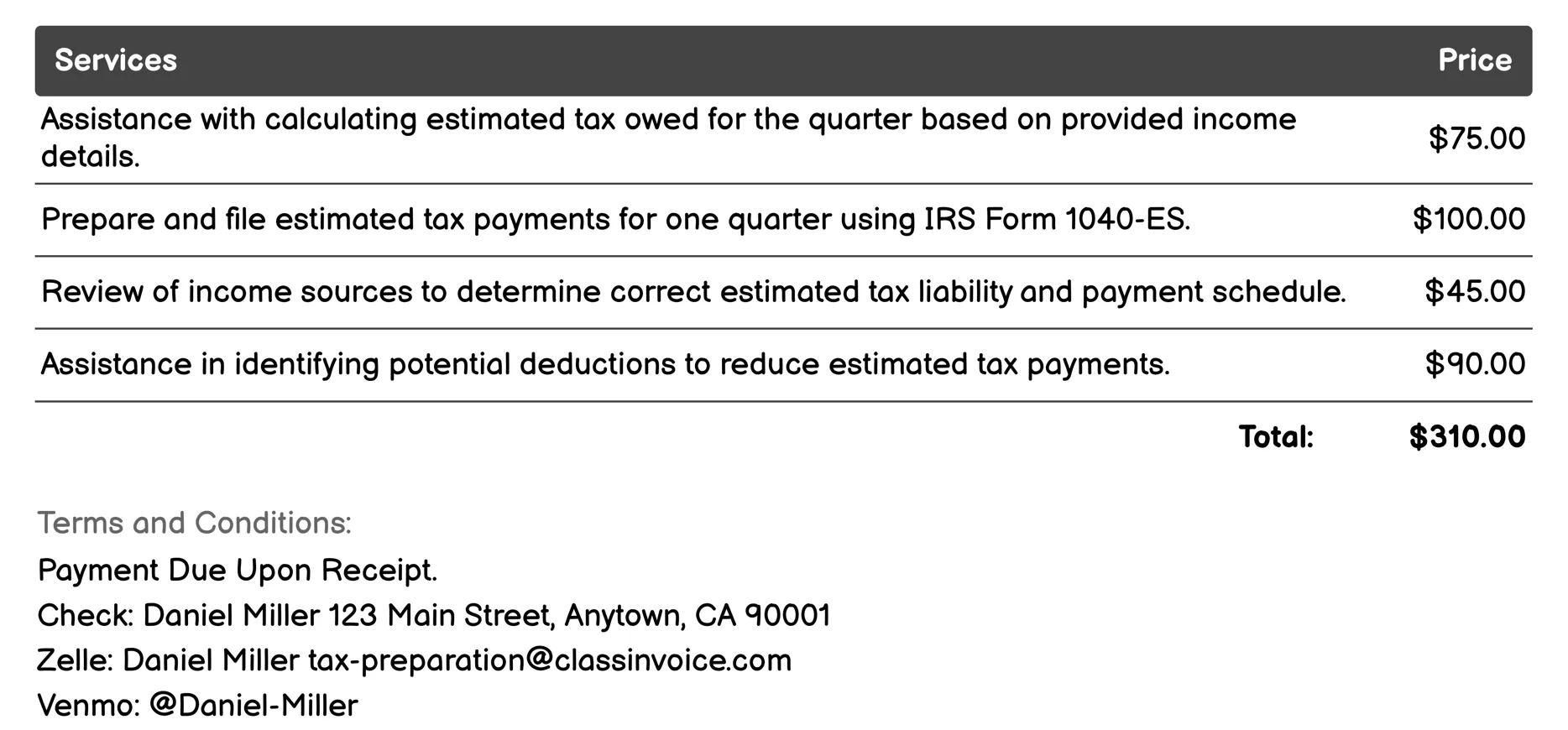

Quarterly Estimated Tax Payments Invoice

This service simplifies quarterly tax management by helping calculate, prepare, and file estimated taxes using IRS Form 1040-ES. It includes reviewing income sources for accurate liability assessment, identifying deductions to minimize payments, scheduling timely payments, and ensuring compliance with IRS requirements. Clients receive guidance on best practices, personalized payment plans, and reminders to avoid penalties. Additionally, the service tracks all payments made throughout the year, offering peace of mind and financial goal alignment.

FAQ

Is the invoice creation process free ?

Yes, creating an invoice using our service is completely free of charge.

Can I use this service for personal or business purposes ?

This service can be used for both personal and business purposes. No registration or subscription is required.

What can I do with the online invoice creation tool ?

You can create and print invoices, or download them in PDF format for free.

How do I get my printed or PDF invoices ?

You can print your invoices directly from the invoice creation tool, or download them in PDF format for free.

Is the invoice creation process secure ?

Yes, all data is encrypted and stored securely to protect your information.