Free Tax Attorneys Invoice Generator

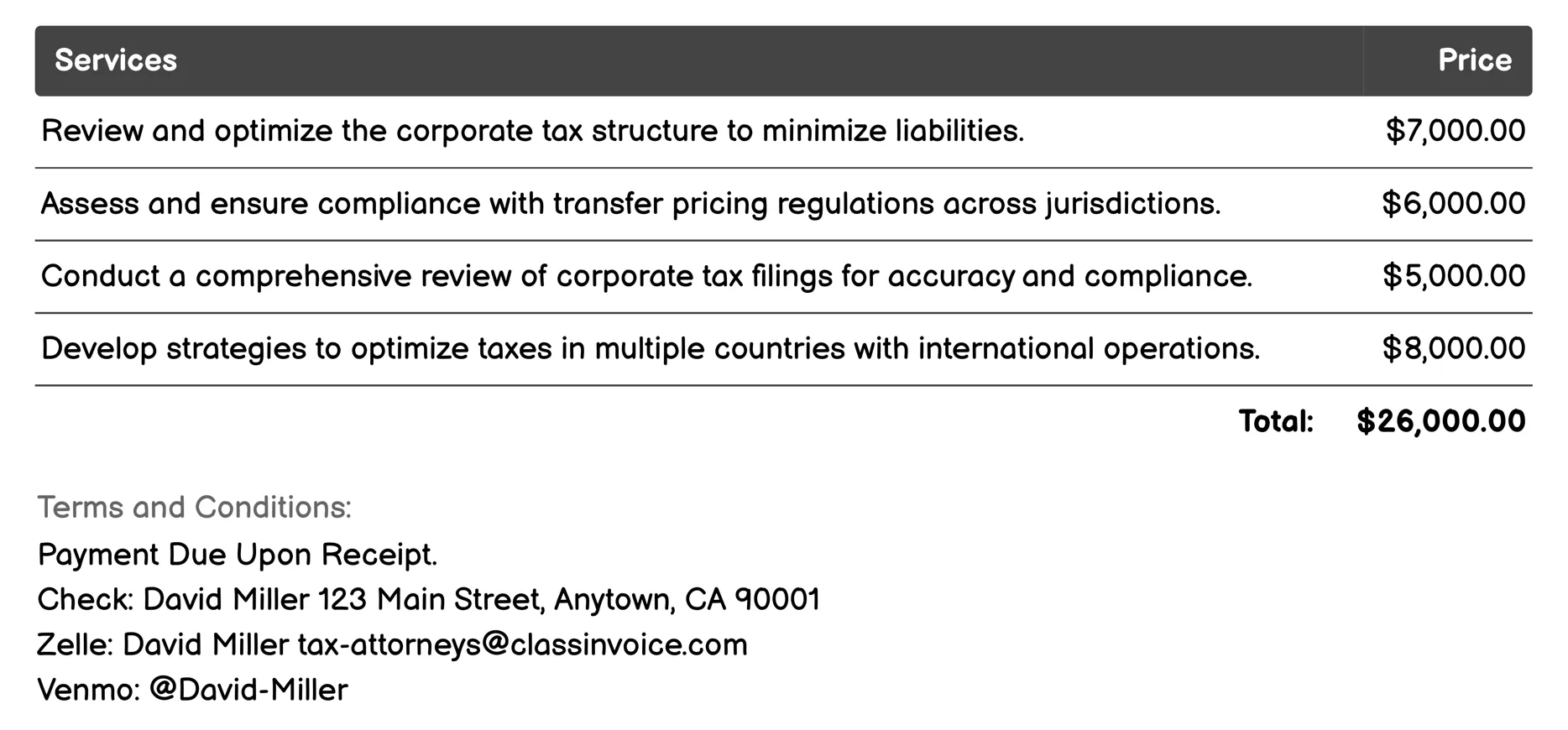

Corporate Tax Planning Invoice

This service helps corporations manage their taxes effectively. Tax experts review and improve how companies are structured for tax purposes, ensuring they pay the least amount legally possible. They check compliance across different countries and offer advice during audits. The service includes planning for international operations, identifying beneficial tax credits, and preparing for mergers or acquisitions with minimal tax impact. Additionally, it involves forecasting future taxes to aid in budgeting and managing any potential risks related to taxation.

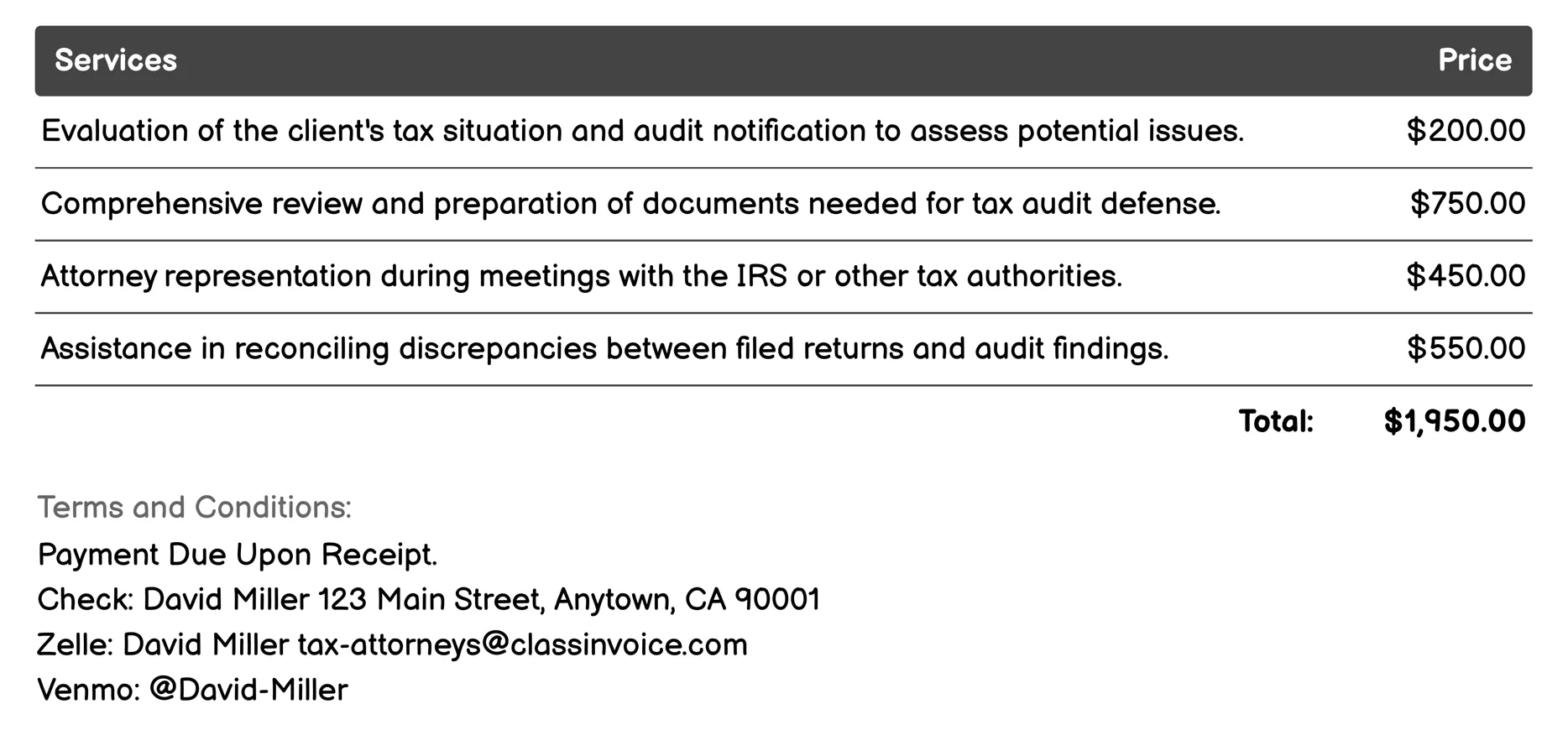

Tax Audits Defense Invoice

Tax Attorneys for Tax Audits Defense offer comprehensive assistance to clients facing IRS audits. They start with an initial consultation to understand your situation and prepare necessary documents. Our attorneys represent you in meetings with tax authorities, helping reconcile any discrepancies found during the audit. We negotiate settlements or penalties on your behalf and can file amended returns if needed. Additionally, we provide litigation support and ensure compliance with current tax laws, keeping you updated throughout the process.

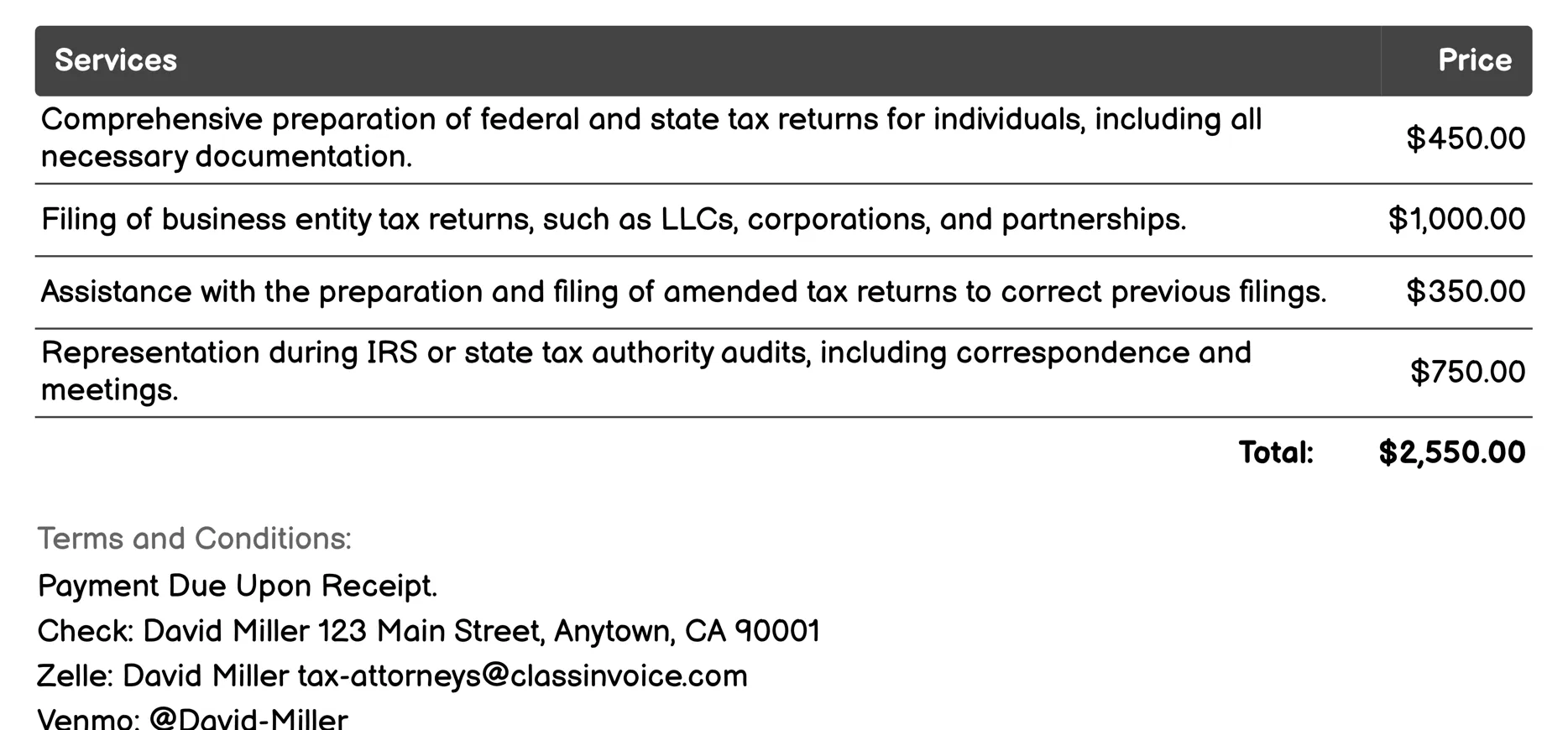

Filing of Tax Returns Invoice

Tax attorneys offer expert services for filing various tax returns. They handle individual, business, and amended returns, ensuring compliance with federal and state laws. Their services include audit representation, strategic tax planning, and international filings. They also assist nonprofits and self-employed individuals in maintaining tax compliance. Additionally, they provide estate and gift return preparation, along with extensions when necessary, to meet all deadlines efficiently.

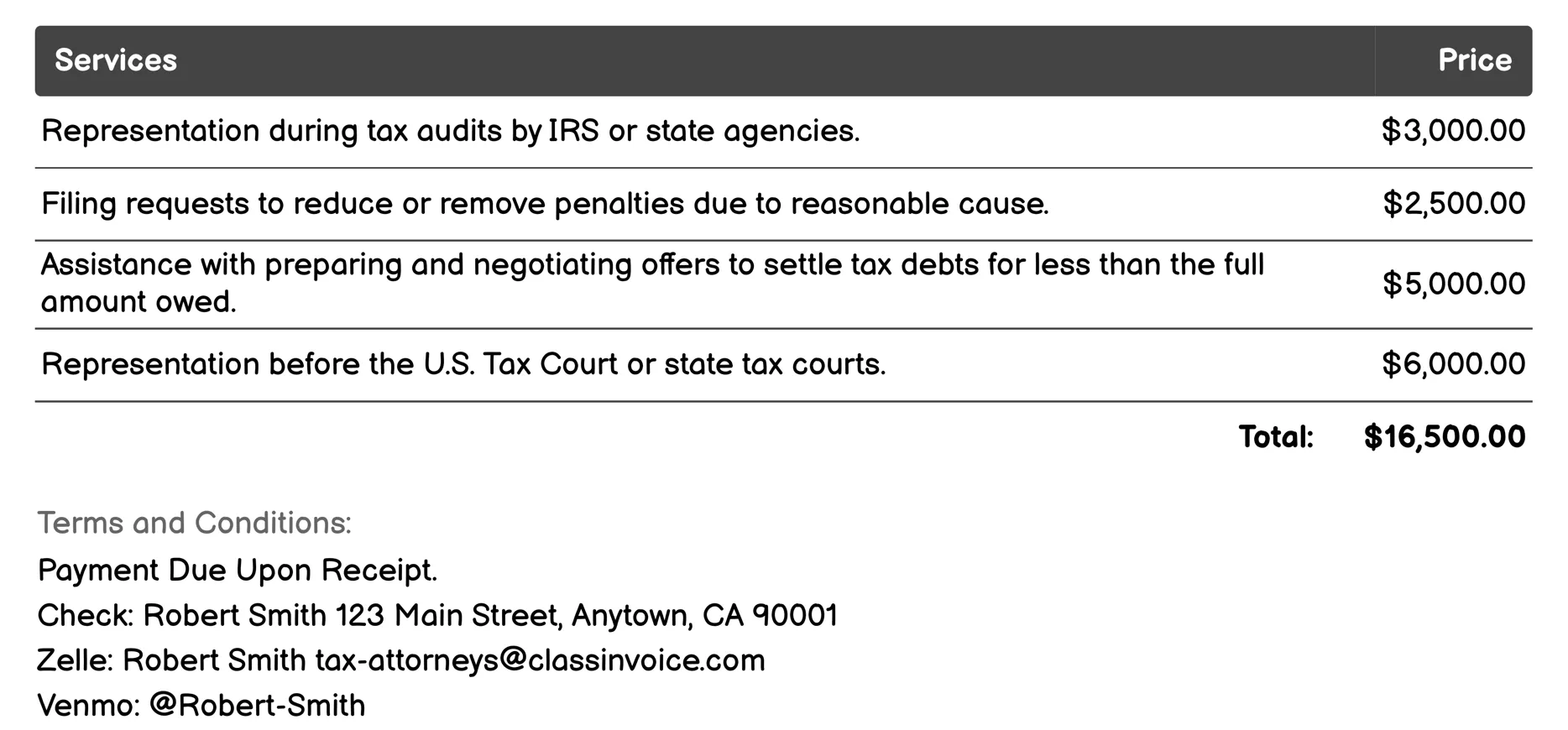

Tax Dispute Resolution Invoice

This service offers expert legal assistance to resolve tax disputes. It includes representation during audits, reducing penalties, negotiating lower settlement amounts, and defending against fraud allegations. The attorneys also prepare for court cases, handle IRS hearings related to collections, assist in creating payment plans, and help with offshore tax issues. They provide strategies to minimize the impact of back taxes, ensuring compliance while protecting your financial interests.

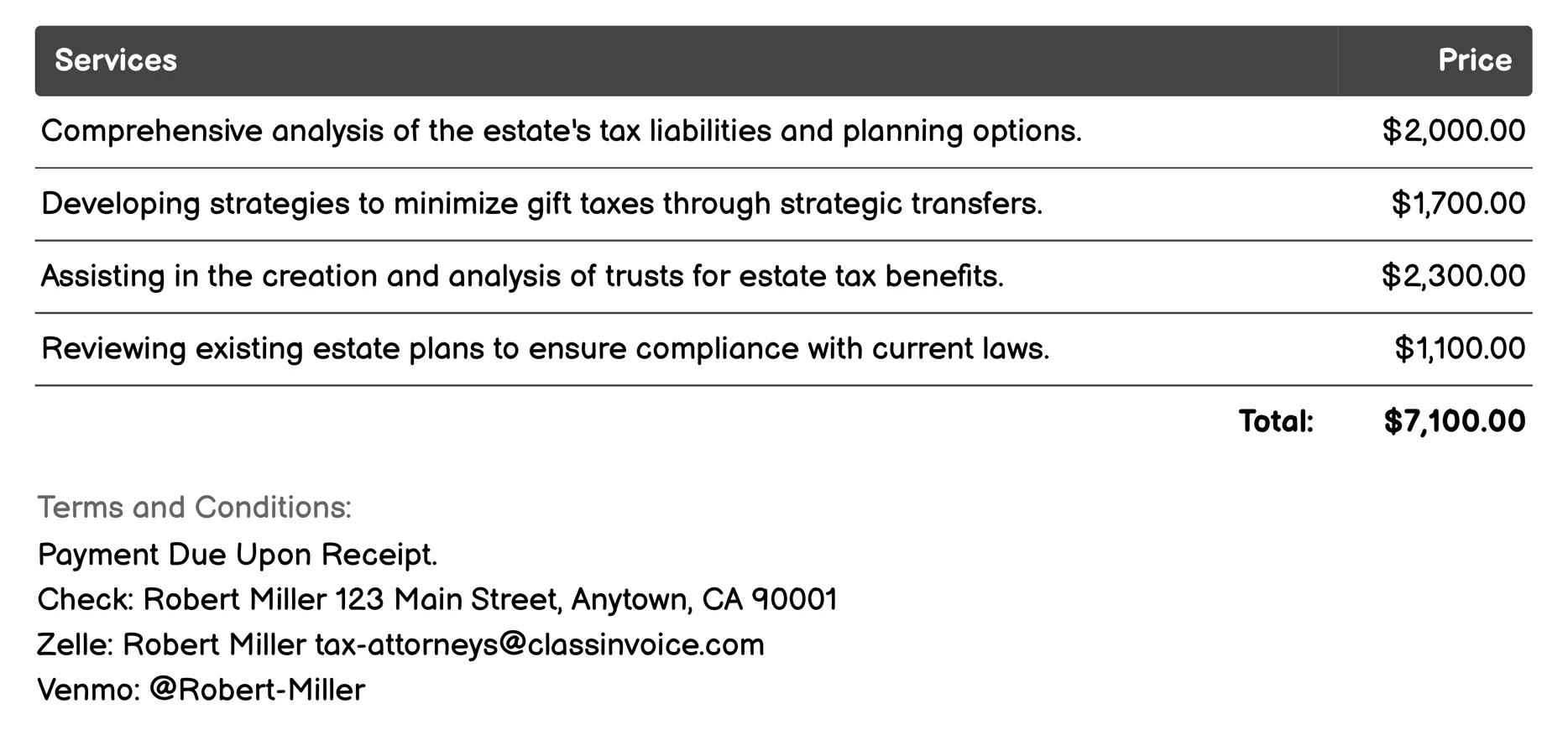

Estate and Gift Tax Planning Invoice

This service offers specialized legal and financial guidance for minimizing estate and gift taxes. Tax attorneys provide comprehensive analysis, strategy development, and compliance audits to optimize tax liabilities within the law. They assist with trust formation, review existing plans, prepare necessary tax returns, and keep clients informed about tax code changes through briefings and workshops. The goal is to ensure legal compliance while strategically reducing tax burdens through planning methods like family limited partnerships.

FAQ

Is the invoice creation process free ?

Yes, creating an invoice using our service is completely free of charge.

Can I use this service for personal or business purposes ?

This service can be used for both personal and business purposes. No registration or subscription is required.

What can I do with the online invoice creation tool ?

You can create and print invoices, or download them in PDF format for free.

How do I get my printed or PDF invoices ?

You can print your invoices directly from the invoice creation tool, or download them in PDF format for free.

Is the invoice creation process secure ?

Yes, all data is encrypted and stored securely to protect your information.