Free Payroll Services Invoice Generator

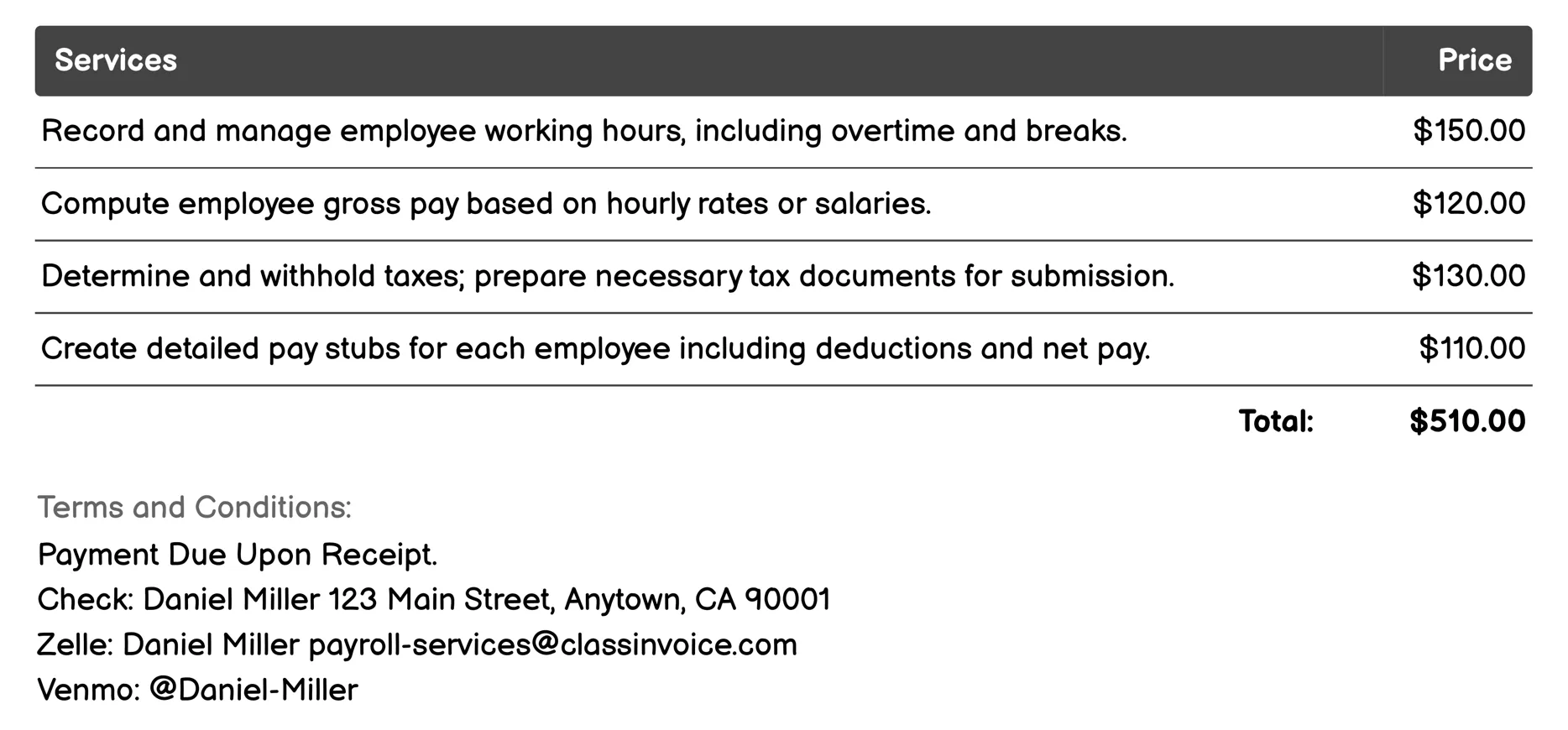

Basic Payroll Processing Invoice

Payroll services for basic payroll processing manage employee hours, calculate gross pay, and handle tax withholdings. They generate pay stubs, set up direct deposits, and manage benefits and deductions. These services ensure accurate payroll reconciliation, prepare year-end reports, track leave balances, and conduct compliance checks to maintain legal standards. This service simplifies payroll tasks for businesses, ensuring timely payments and regulatory adherence.

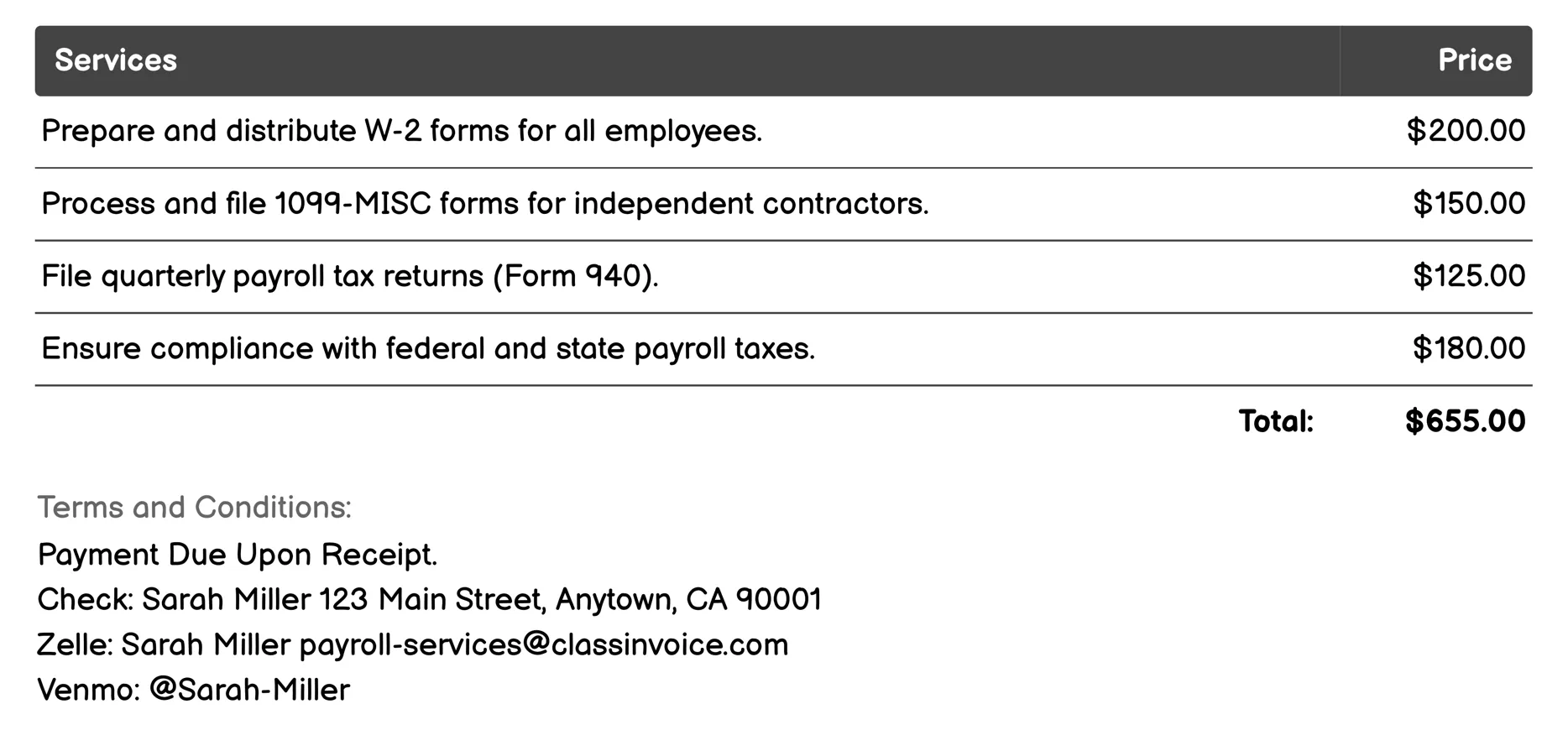

Tax Filing and Compliance Invoice

Payroll Services for Tax Filing and Compliance ensures that your business adheres to tax laws by handling essential payroll-related tasks. This includes preparing W-2 and 1099-MISC forms, filing quarterly and annual taxes like Form 940, ensuring payroll tax compliance, and managing both federal and state unemployment taxes. The service also helps optimize tax withholdings for employees, conducts audits of payroll practices, provides assistance with employee tax filings, and offers strategies to maximize tax deductions. These services streamline the complex process of payroll management and ensure accuracy in tax reporting and payments.

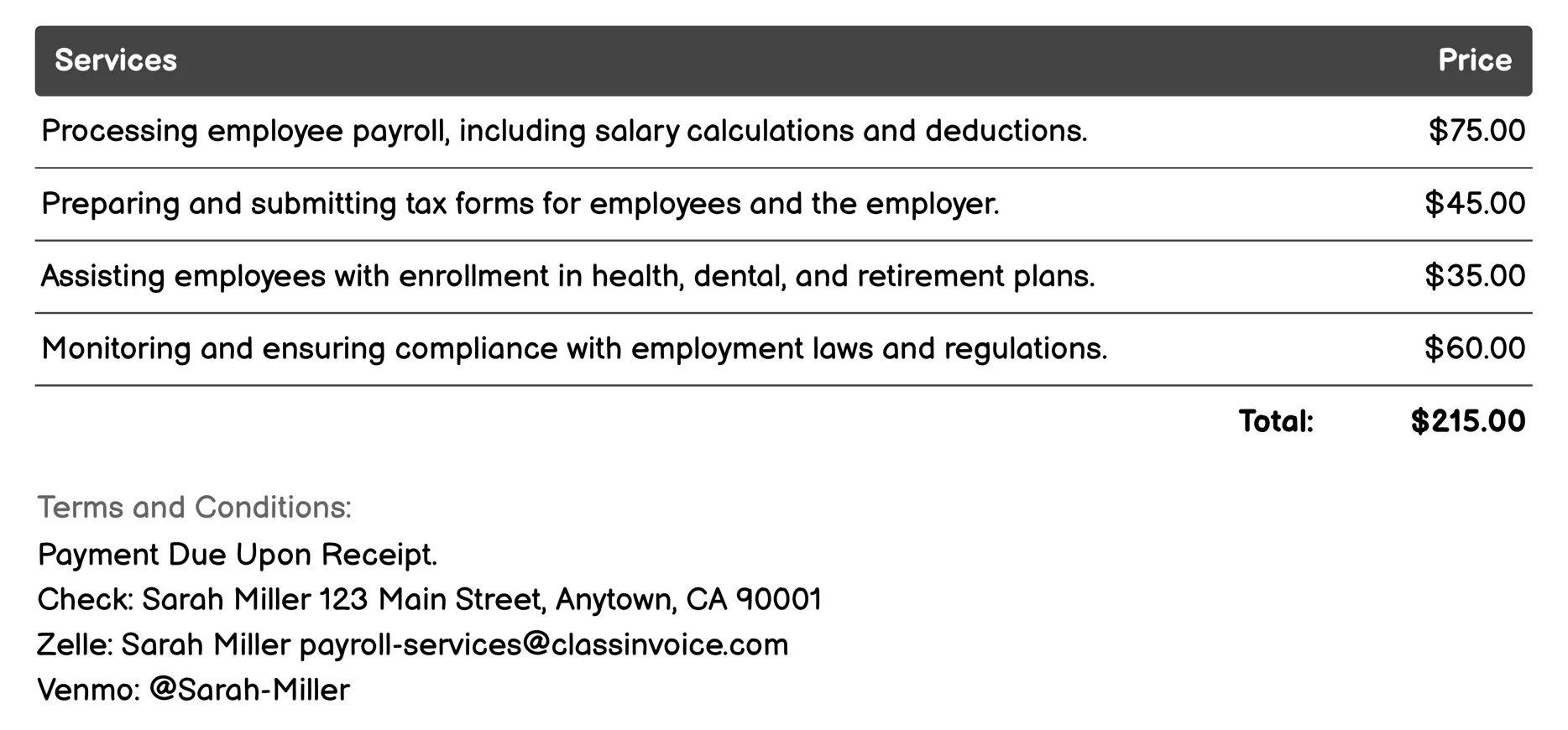

Benefits Administration Invoice

Payroll Services for Benefits Administration streamline payroll management and benefits processing. They handle employee pay calculations, deductions, and tax filings efficiently. These services ensure compliance with employment laws while assisting in benefits enrollment like health and retirement plans. New hires' payroll details are seamlessly integrated, and year-end wage reports are prepared as required by law. Direct deposits are facilitated for prompt salary payments. Additionally, regular audits and reviews of payroll records ensure accuracy. Timekeeping systems are synced with payroll software, and detailed analysis of benefit costs aids strategic planning.

Time and Attendance Tracking Invoice

This payroll service offers comprehensive tools for managing employee attendance and time tracking. It includes basic systems like time clocks, mobile check-in apps, and biometric solutions, ensuring accurate records of hours worked. The integration with payroll software automates salary calculations based on tracked time, reducing manual errors in invoicing. Features such as time-off management, shift scheduling, and compliance monitoring ensure efficient operation and adherence to labor laws. Additionally, it supports remote work tracking and provides detailed attendance reports, simplifying the invoicing process for businesses of all sizes.

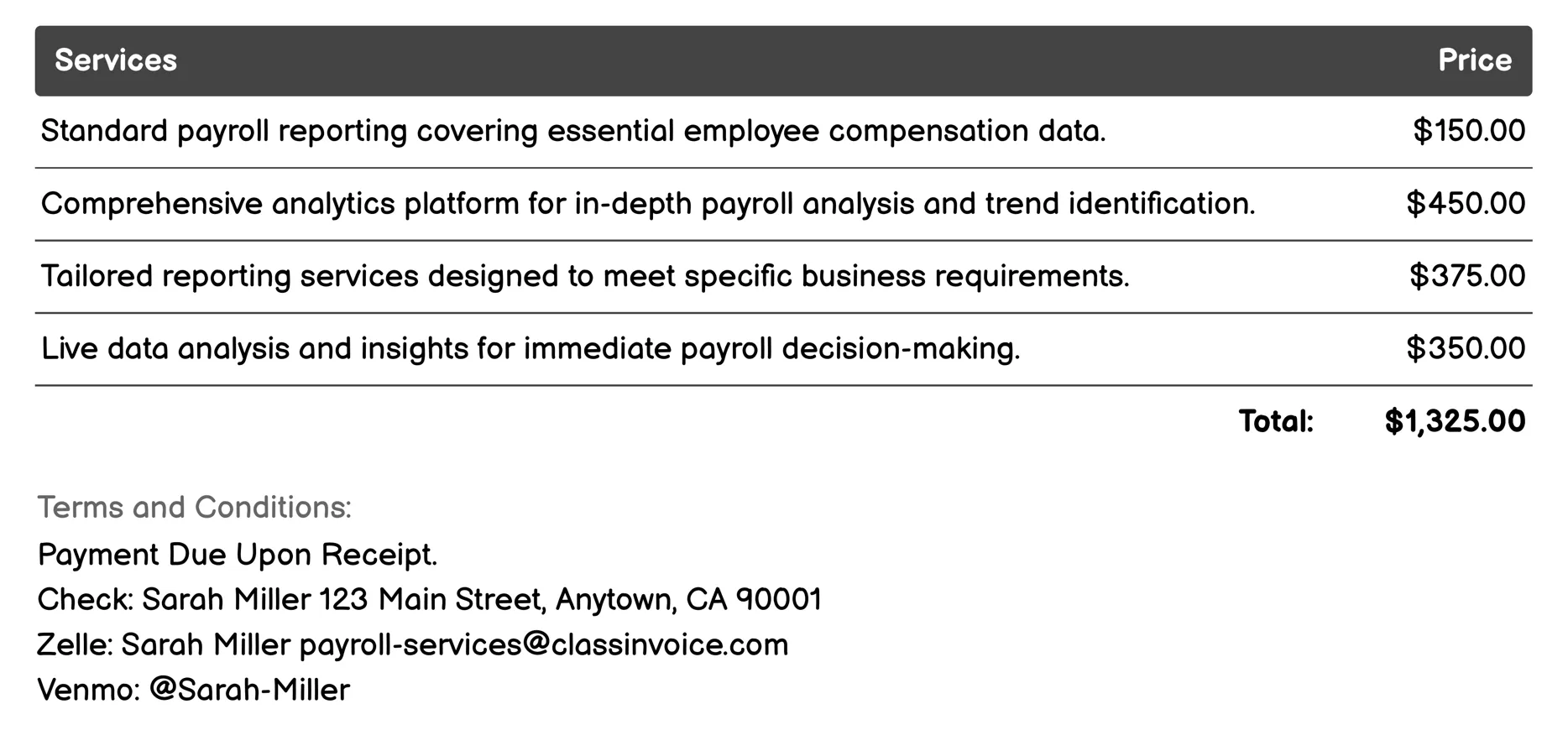

Payroll Reporting and Analytics Invoice

This service provides comprehensive payroll reporting and analytics to help businesses manage employee compensation effectively. It offers standard reports on basic pay data, advanced dashboards for deeper insights, and customized solutions tailored to specific needs. With real-time analysis, historical trend identification, compliance checks, and forecasting capabilities, it ensures accurate and strategic payroll management. Integration with financial systems allows seamless incorporation of payroll data into broader business reporting.

FAQ

Is the invoice creation process free ?

Yes, creating an invoice using our service is completely free of charge.

Can I use this service for personal or business purposes ?

This service can be used for both personal and business purposes. No registration or subscription is required.

What can I do with the online invoice creation tool ?

You can create and print invoices, or download them in PDF format for free.

How do I get my printed or PDF invoices ?

You can print your invoices directly from the invoice creation tool, or download them in PDF format for free.

Is the invoice creation process secure ?

Yes, all data is encrypted and stored securely to protect your information.