Free Mortgage Advisor Invoice Generator

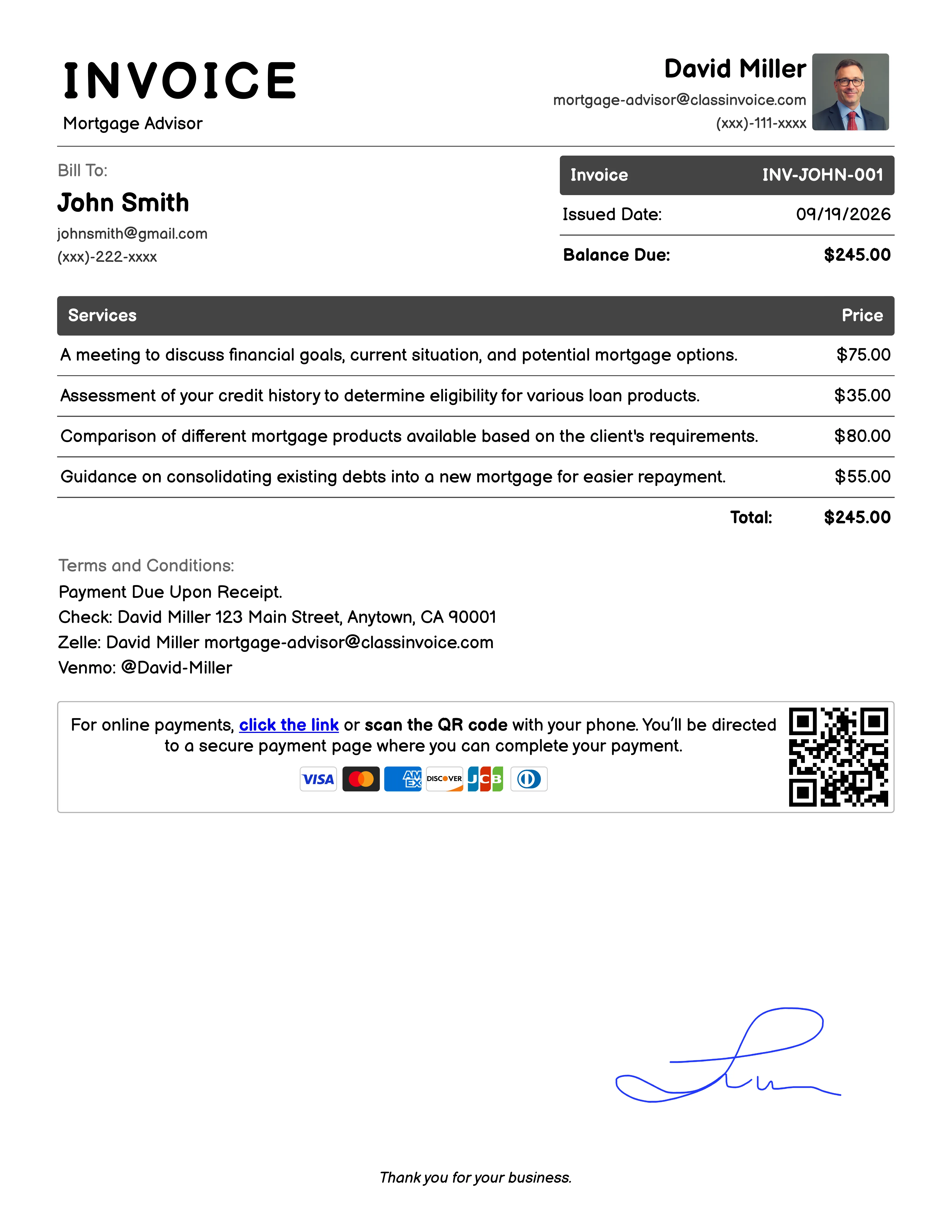

Loan Origination Invoice

A Mortgage Advisor for Loan Origination provides comprehensive support throughout the home buying process. They guide clients from initial financial assessments to securing loans, ensuring all steps are clear and manageable. Advisors assist with document preparation, rate comparisons, and closing coordination, making the complex mortgage journey smoother and more efficient. Their services include post-loan support to help maintain financial stability and address any arising issues, providing peace of mind for both first-time buyers and seasoned homebuyers.

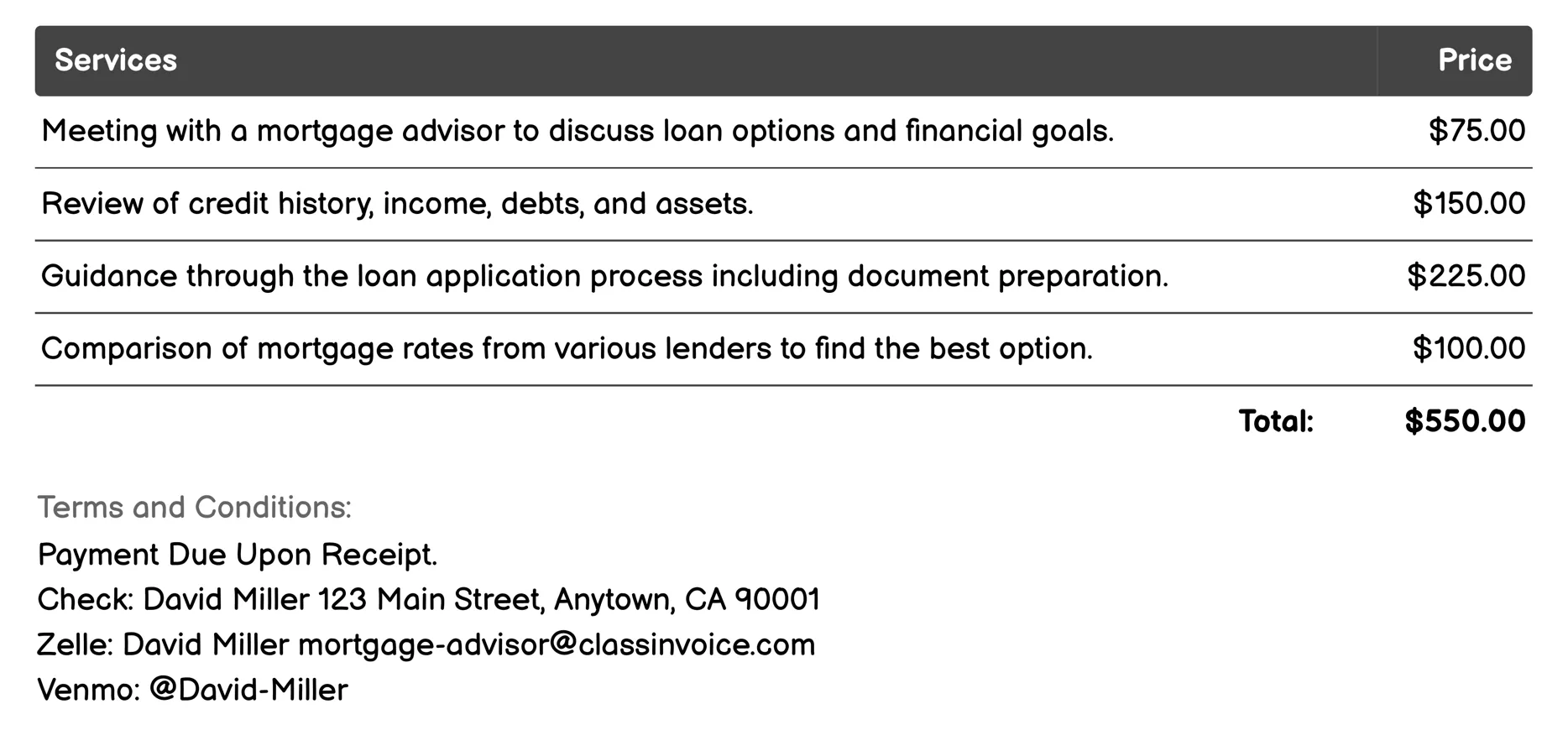

Rate Shopping Invoice

This Mortgage Advisor service offers tailored support for navigating mortgage rate shopping. It provides a detailed comparison of current rates, customizes loan programs to suit client needs, and aids in negotiating favorable terms with lenders. The service includes guidance on locking in rates, supporting the pre-approval process, and preparing necessary documentation. Clients receive insights into future rate trends and assessments of interest rate risks, ensuring informed decisions. Additionally, it helps match suitable loan products and develops strategies for effective rate shopping.

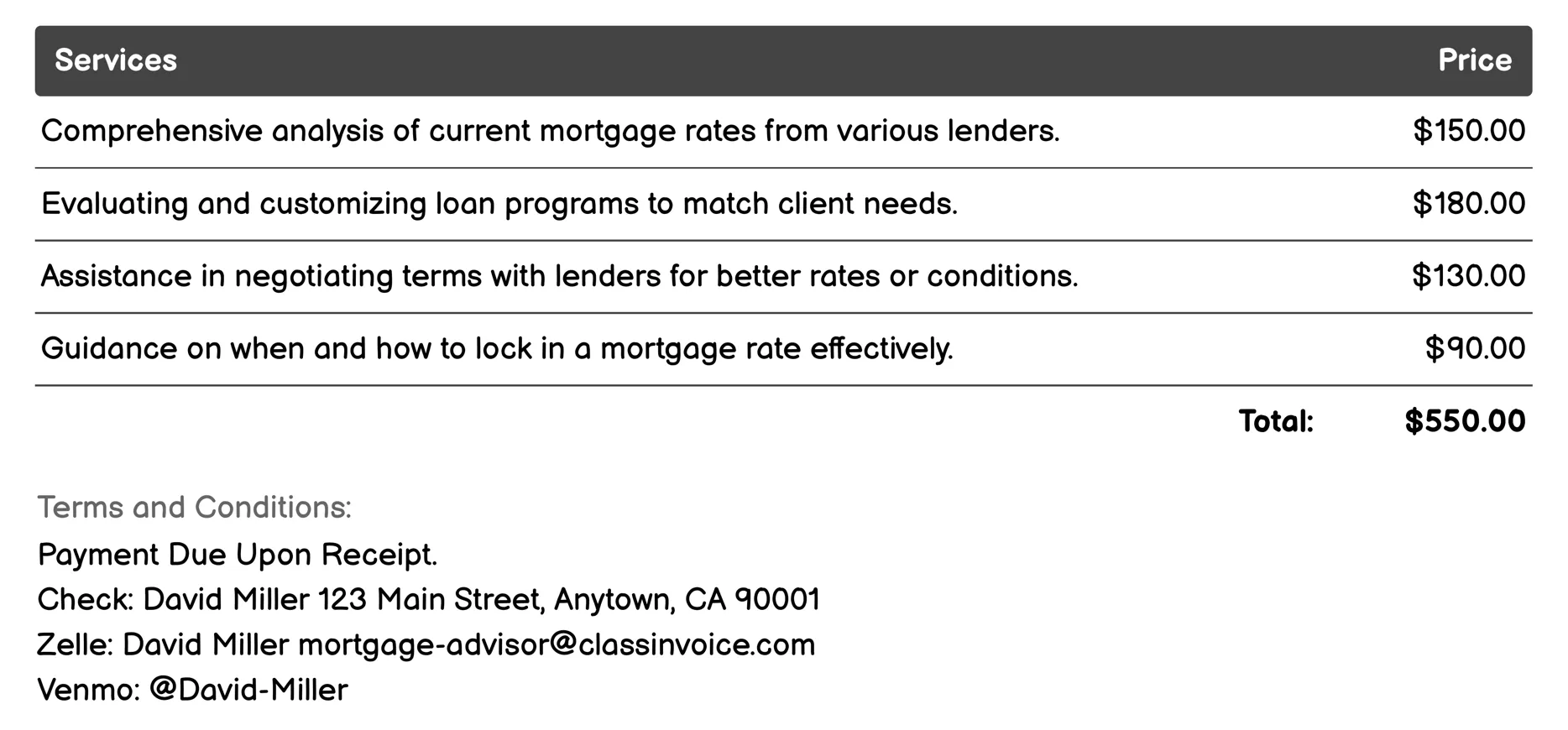

Financial Planning Invoice

The 'Mortgage Advisor for Financial Planning' service helps individuals navigate the complexities of acquiring a mortgage. It offers personalized guidance through each step, from application assistance to financial planning after approval. The advisor evaluates interest rates and loan terms, reviews credit scores, plans down payments, and considers refinancing options. Additionally, it assists with setting up payment calculators, assessing insurance needs, advising on property valuation, and developing a comprehensive post-mortgage budget plan. This service aims to ensure clients secure the best possible mortgage terms while maintaining financial stability.

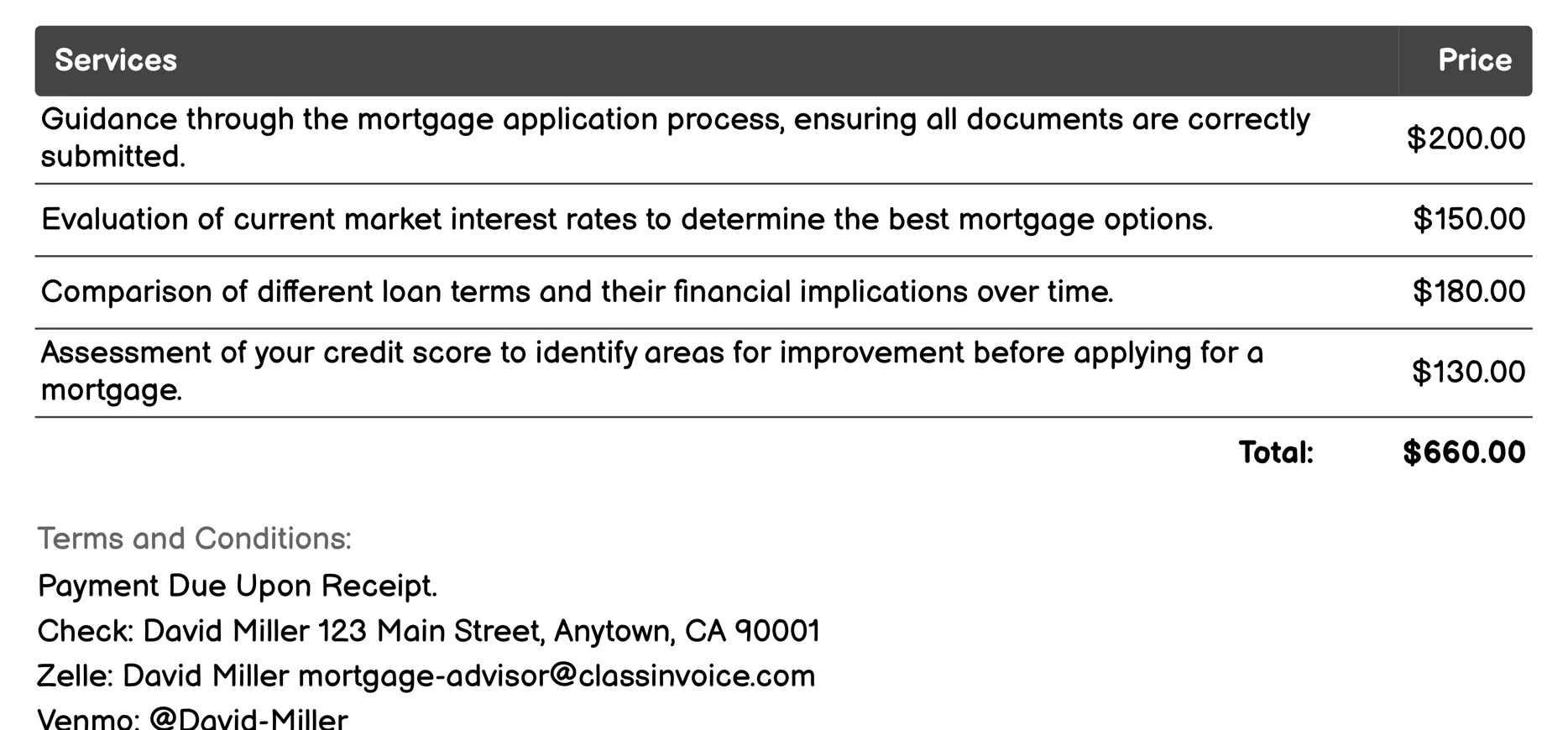

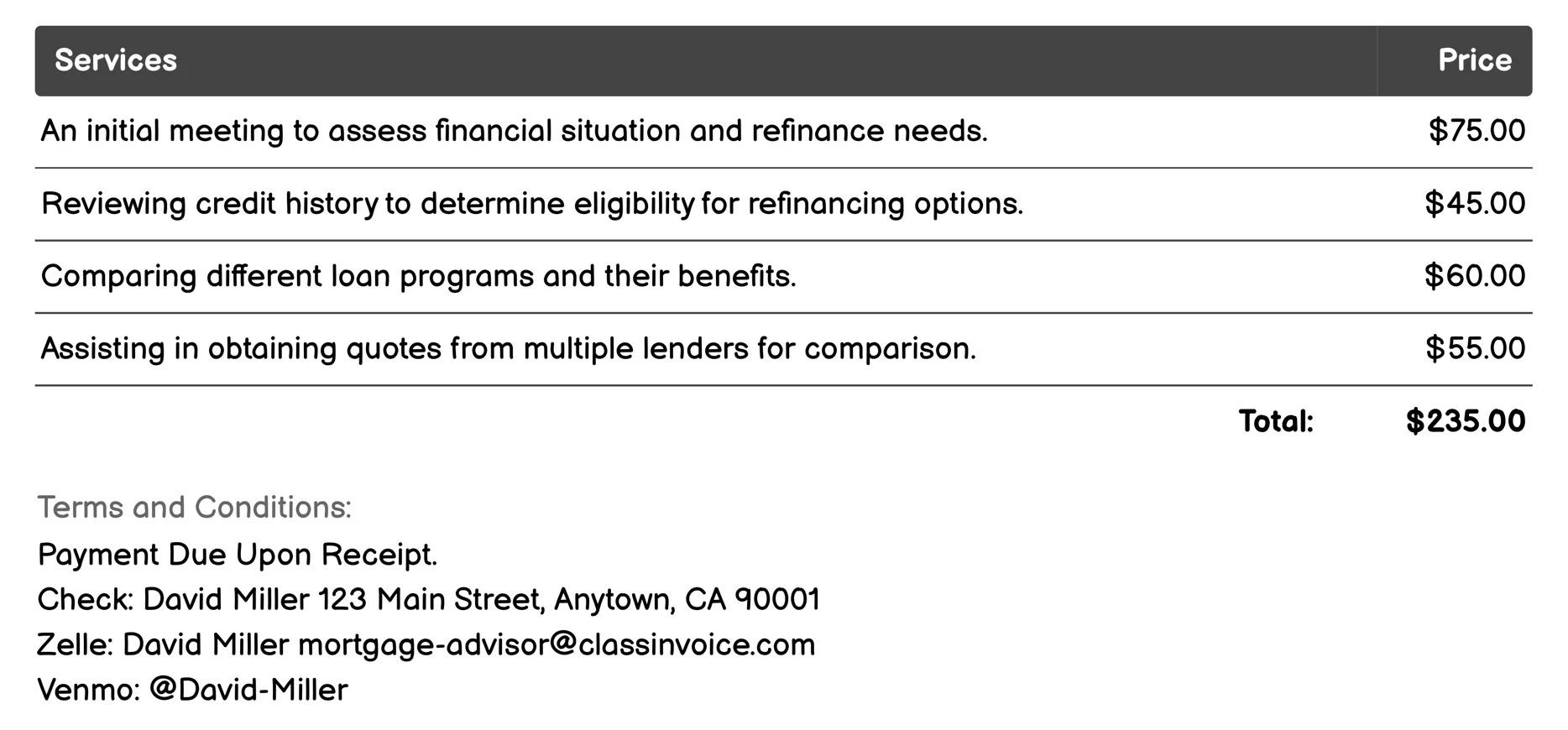

Refinancing Consultation Invoice

A Mortgage Advisor for Refinancing Consultation assists clients through the refinancing process. Starting with an initial consultation to assess needs, they review credit reports and evaluate loan options. Advisors help secure rate quotes from lenders and prepare applications. They negotiate terms on behalf of the client, guide them through closing, and ensure post-closing satisfaction. Additionally, they provide advice on locking in rates and how refinancing fits into broader financial planning. This service simplifies the complex task of refinancing for homeowners.

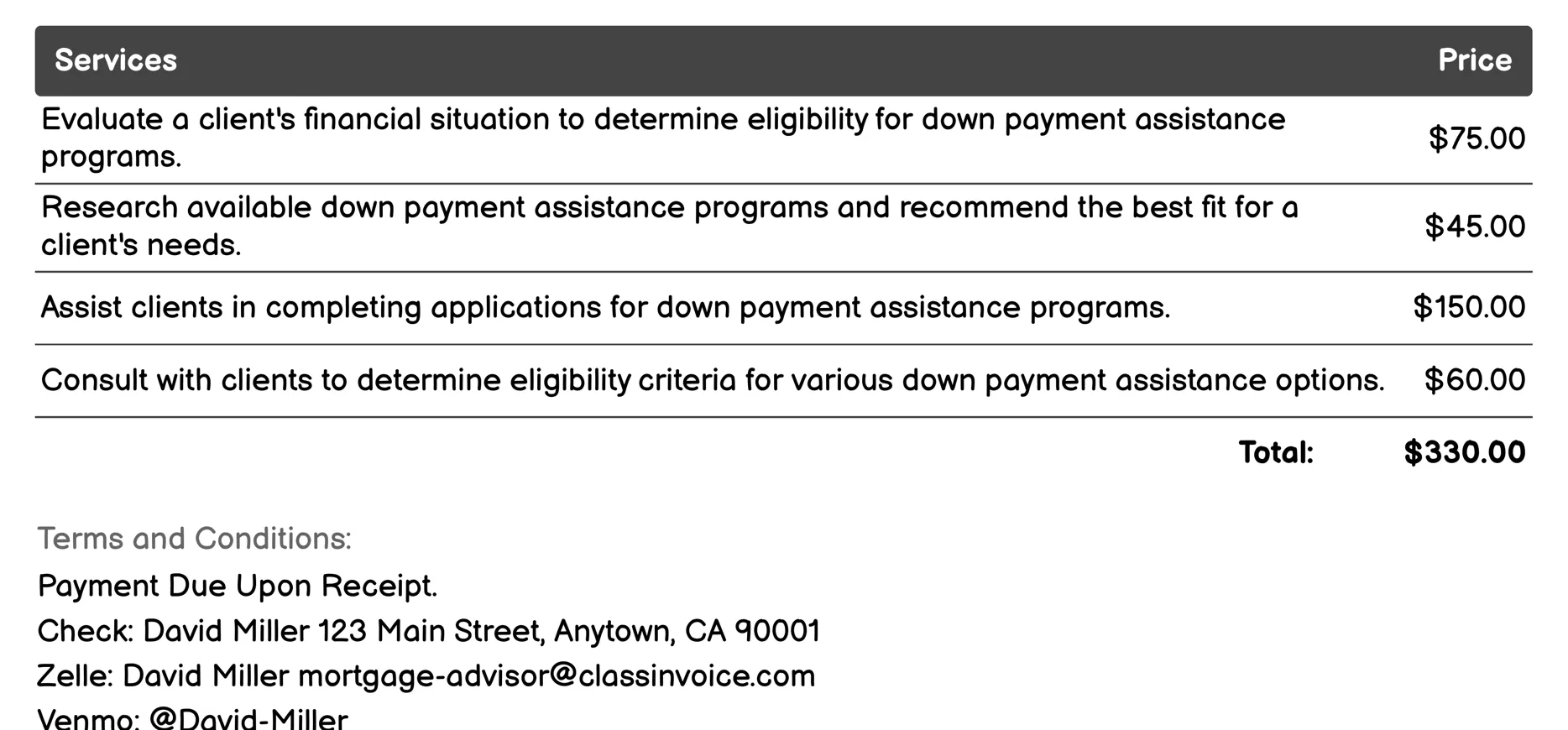

Down Payment Assistance Programs Invoice

This service assists clients in securing down payment assistance for home buying. It evaluates financial situations, identifies suitable programs, and helps with applications and documentation. The advisor provides consultations on eligibility and enrollment support, ensuring a smooth process. Additionally, they offer follow-up services, financial education, credit reviews, and budget planning to prepare clients for successful mortgage management.

FAQ

Is the invoice creation process free ?

Yes, creating an invoice using our service is completely free of charge.

Can I use this service for personal or business purposes ?

This service can be used for both personal and business purposes. No registration or subscription is required.

What can I do with the online invoice creation tool ?

You can create and print invoices, or download them in PDF format for free.

How do I get my printed or PDF invoices ?

You can print your invoices directly from the invoice creation tool, or download them in PDF format for free.

Is the invoice creation process secure ?

Yes, all data is encrypted and stored securely to protect your information.