Free Hedging Invoice Generator

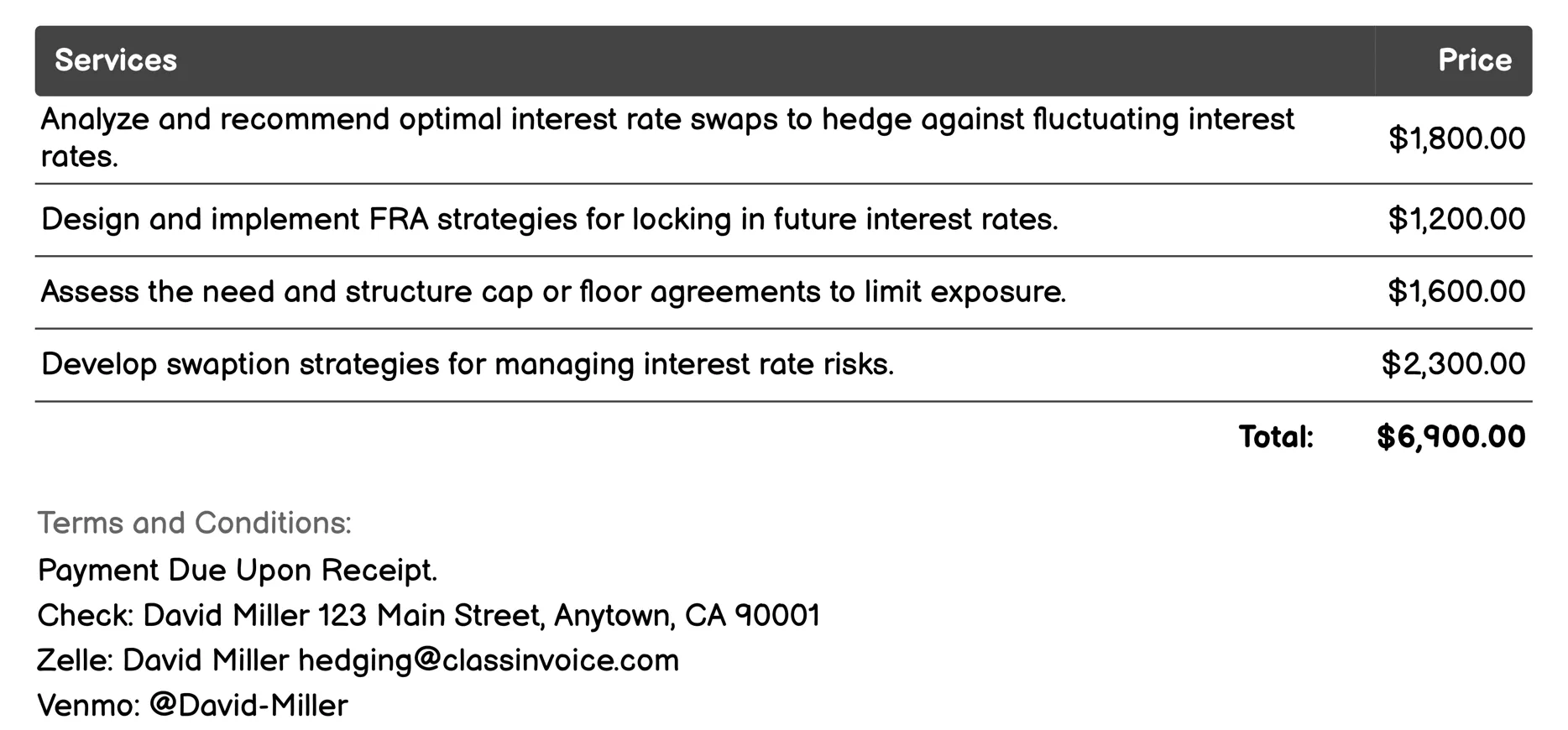

Interest Rate Hedging Invoice

This service focuses on managing interest rate risks through various financial strategies and instruments. It includes analyzing, recommending, and implementing tools like swaps, forward agreements, caps/floors, and swaptions to stabilize costs against fluctuating rates. The service also involves designing customized hedging policies, conducting risk assessments, and providing market forecasts. By simulating potential impacts and optimizing existing strategies, it helps organizations protect their financial health from interest rate volatility.

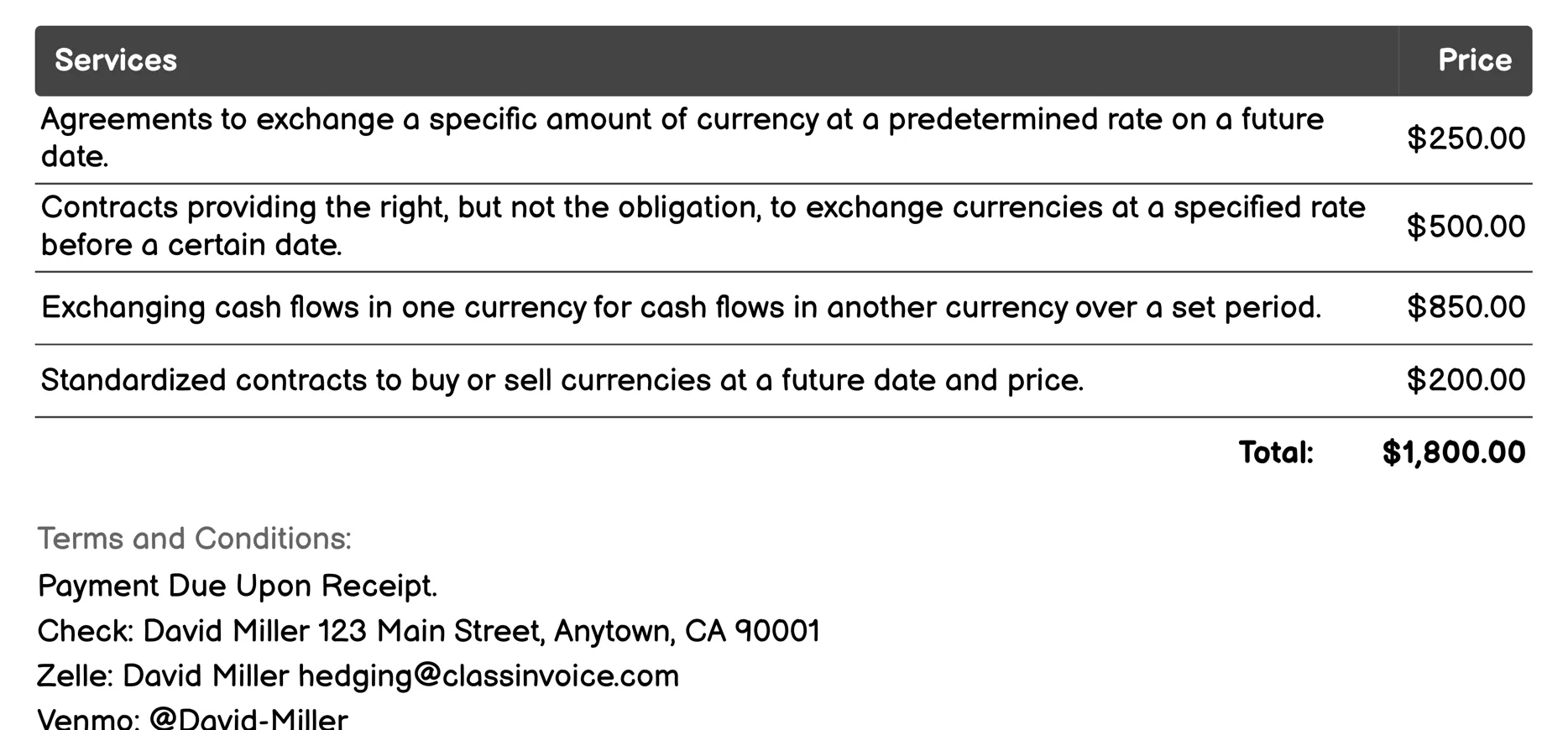

Currency Exchange Hedging Invoice

This service provides comprehensive solutions for managing currency exchange risks. It includes various financial instruments like forward contracts, options, and swaps to lock in favorable rates or offer flexibility. Additionally, it offers strategic approaches such as natural hedging and dynamic strategies, along with specialized software and consulting services. These tools help businesses protect against unfavorable currency fluctuations, ensuring more predictable financial outcomes and stable invoicing processes.

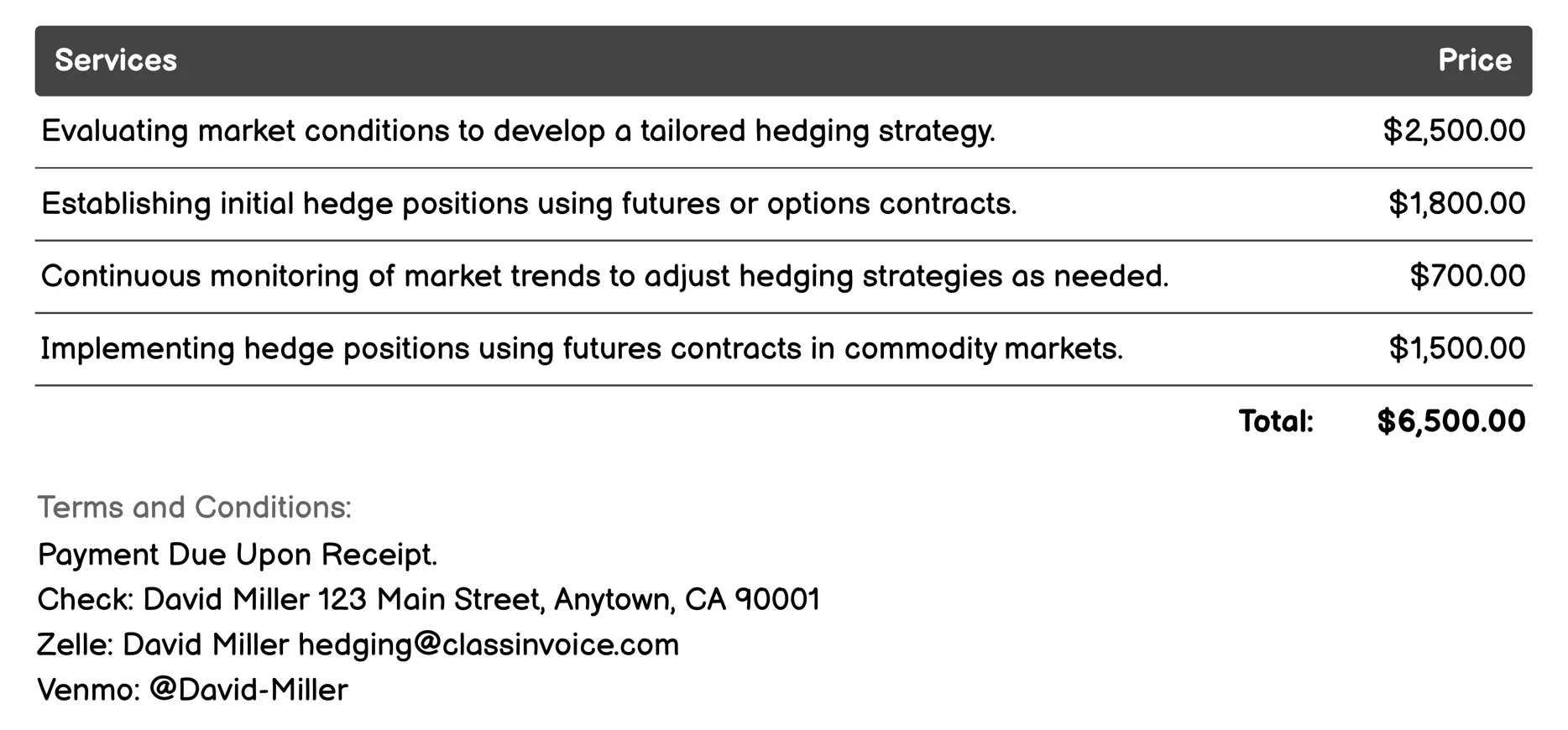

Commodity Price Hedging Invoice

This service focuses on managing risks related to commodity price fluctuations. It involves assessing market conditions, setting up initial hedge positions using futures or options contracts, and continuously monitoring these strategies. The approach includes analyzing derivatives markets, evaluating cash flow impacts, and conducting stress tests to ensure effectiveness under various scenarios. Comprehensive reporting is provided to track performance and adjust strategies as needed.

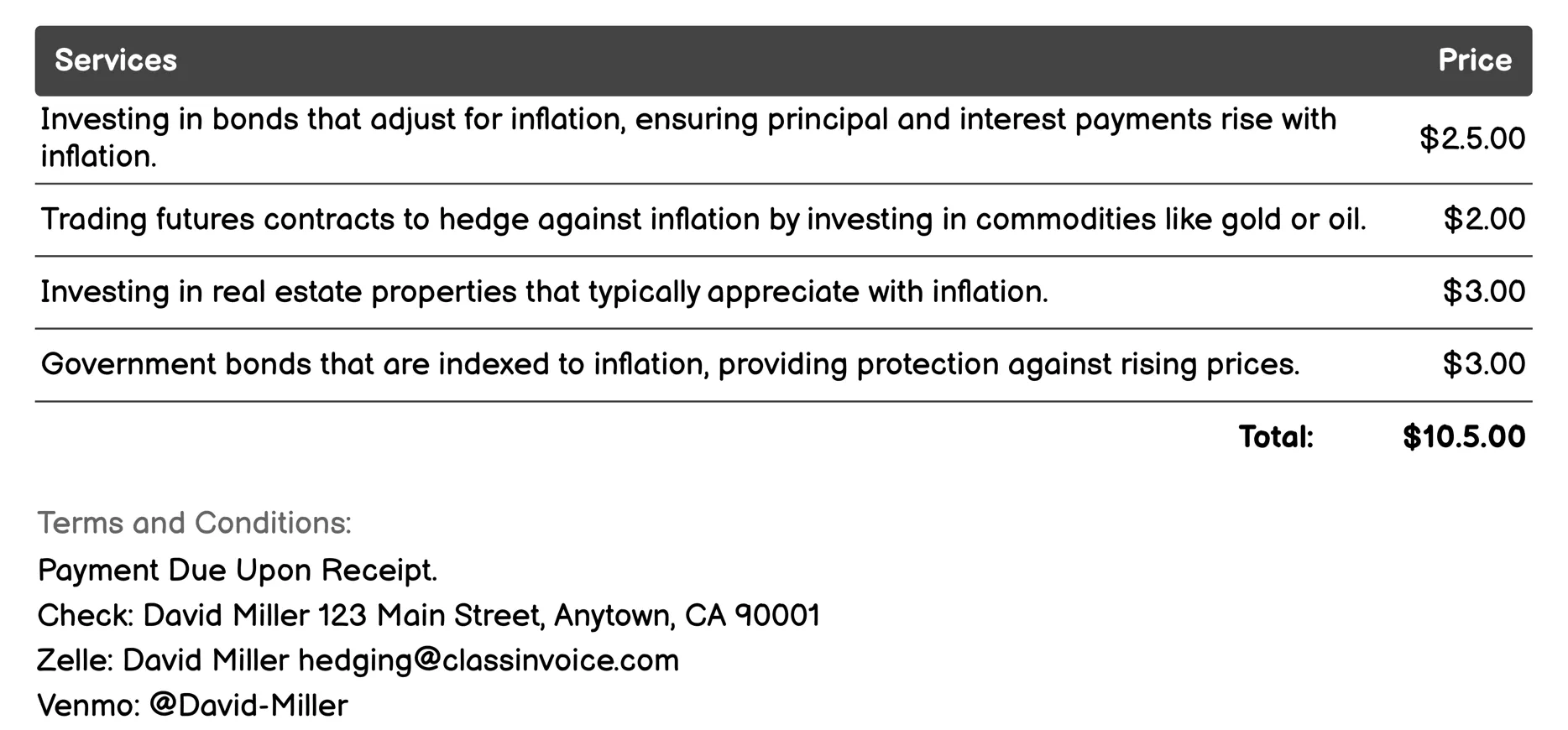

Inflation Hedging Invoice

Hedging for inflation involves strategies to protect your investments from losing value due to rising prices. This service offers diverse options like inflation-linked bonds, commodity futures, and real estate trusts that adjust with inflation. TIPS and gold ETFs provide government-backed and precious metal hedges, respectively. Investing in consumer staples stocks or foreign currencies can also help maintain purchasing power. Infrastructure projects offer steady returns while collectibles appreciate over time. These measures ensure your investments grow alongside or outpace inflation, safeguarding your financial future.

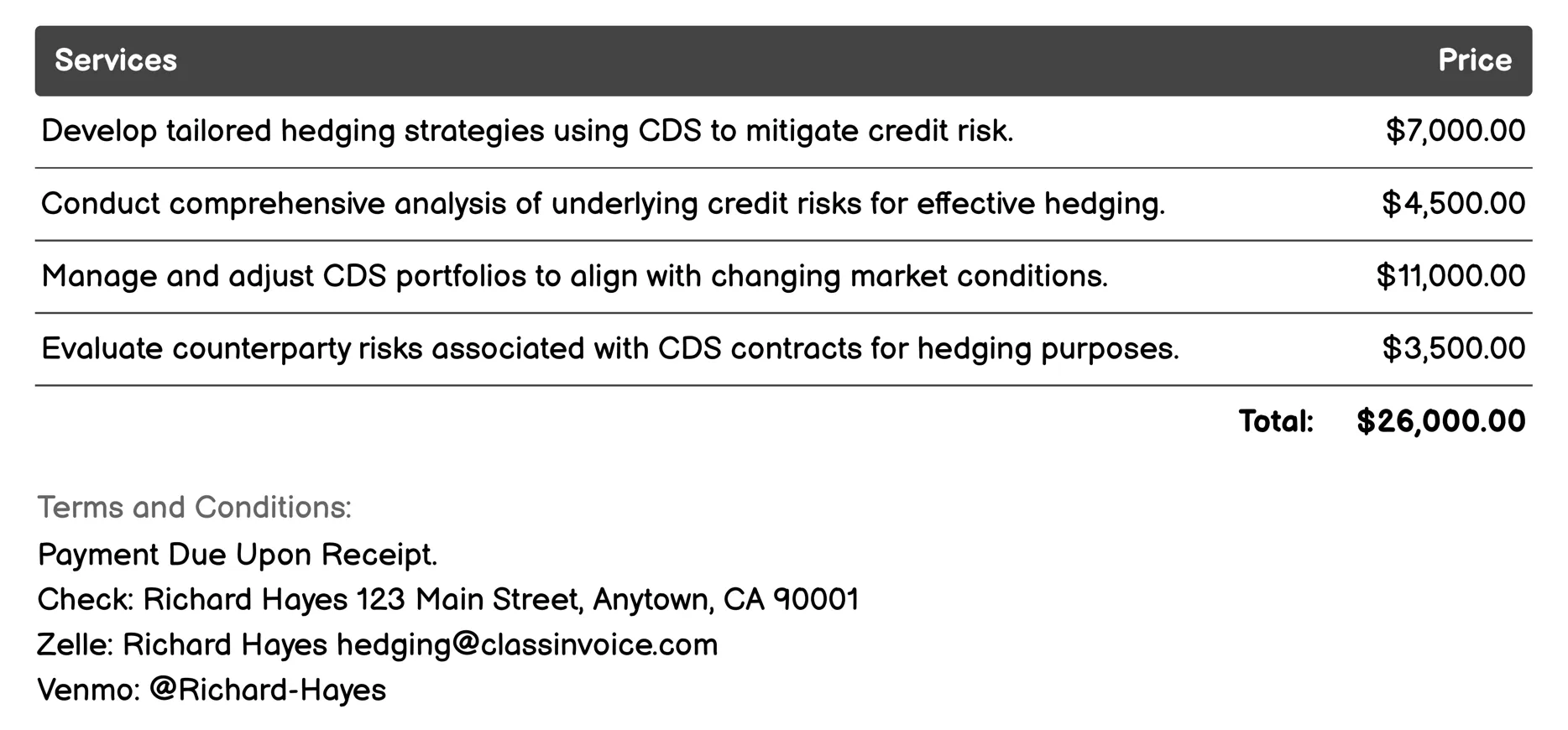

Credit Default Swaps (CDS) Invoice

This service focuses on using Credit Default Swaps (CDS) to manage and reduce credit risk. It involves crafting customized strategies, assessing risks associated with CDS contracts, ensuring regulatory compliance, and accurately valuing CDS portfolios. The service also includes managing hedging portfolios in response to market changes, analyzing market risks, conducting stress tests, assisting with transaction execution, and providing ongoing monitoring and reporting services. This ensures that financial objectives are consistently met while mitigating potential credit risks effectively.

FAQ

Is the invoice creation process free ?

Yes, creating an invoice using our service is completely free of charge.

Can I use this service for personal or business purposes ?

This service can be used for both personal and business purposes. No registration or subscription is required.

What can I do with the online invoice creation tool ?

You can create and print invoices, or download them in PDF format for free.

How do I get my printed or PDF invoices ?

You can print your invoices directly from the invoice creation tool, or download them in PDF format for free.

Is the invoice creation process secure ?

Yes, all data is encrypted and stored securely to protect your information.